unified estate tax credit 2021

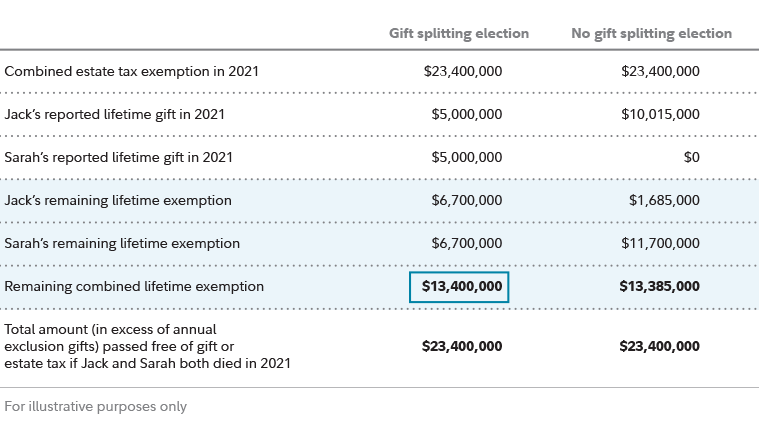

Gift and Estate Tax Exemptions The Unified Credit. Or of course you can use the unified tax credit to do a little bit of both.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

A DC Estate Tax Return Form D-76 or Form D-76 EZ must be filed.

. The taxes are different but they share some major similarities. A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

In other words use it or lose it. A key component of this exclusion is the basic exclusion amount BEA. The size of the estate tax exemption meant that a mere 01 of.

This is called the unified credit. Ad Get free estate planning strategies. Then there is the exemption for gifts and estate taxes.

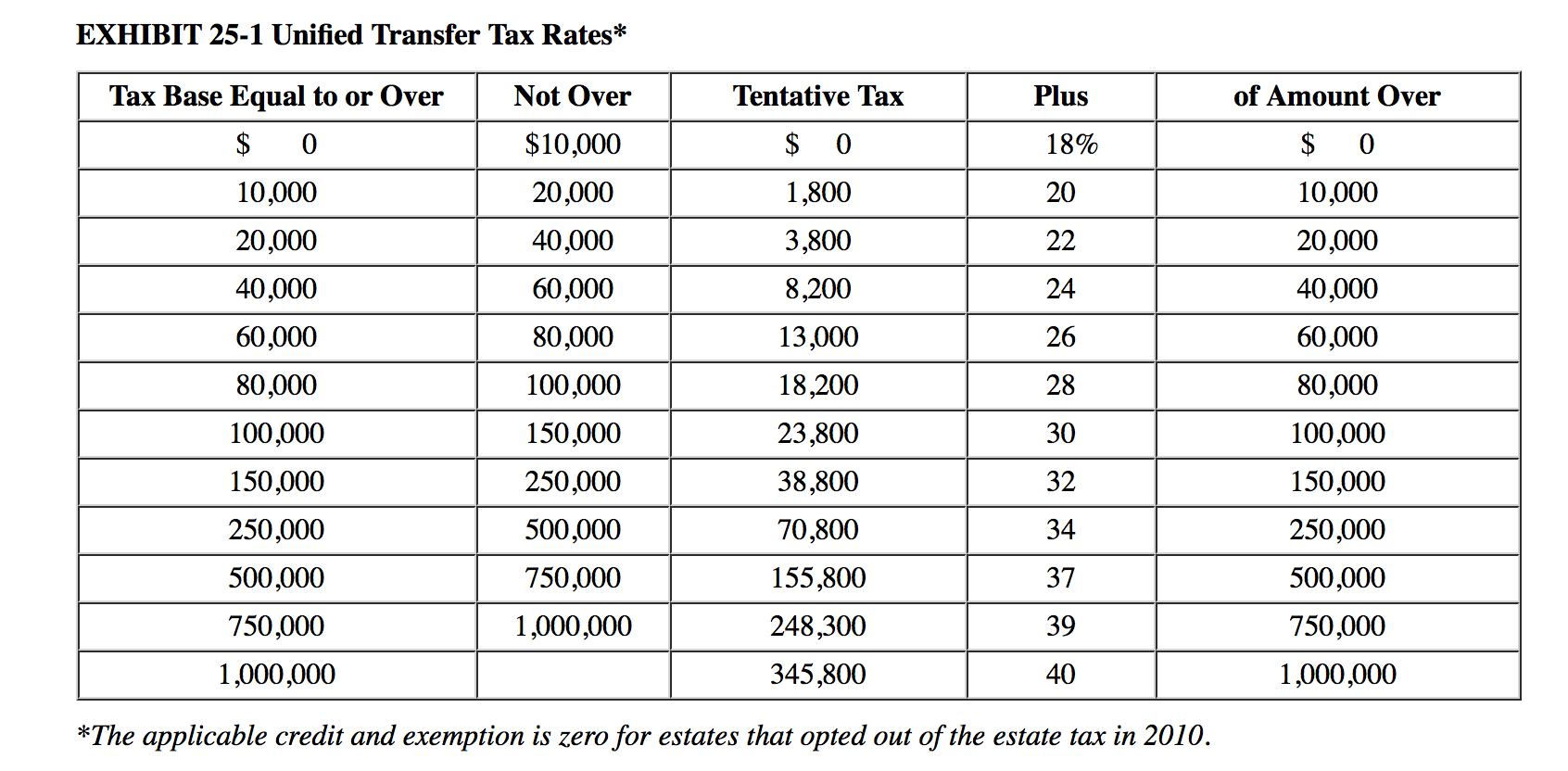

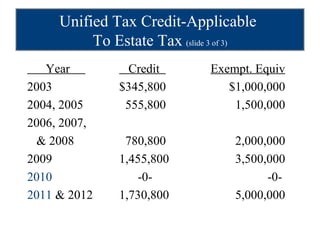

Wednesday January 20 2021. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Any tax due is determined after applying a credit based on an applicable exclusion amount.

The federal estate tax exemption for 2022 is 1206 million. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. They are particularly valuable to business owners who intend to pass ownership of their companies to heirs or.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. Unified Tax Credit for the Elderly Form SC-40 2021 Unified Tax Credit for the Elderly FORM SC-40 Married Claimants Must File Jointly State Form 44404 R20 9-21 Your first name Initial Last name Spouses first name Initial Last name Due April 18 2022 Your Social Security Number Spouses Social Security Number Present address number and street or rural. The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021.

2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code. In short the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes. In October 2020 the IRS released Rev.

Citizen received the same exemption credit so that you could as a couple give a full 7 million to your heirs free of the. Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table. The annual gift tax exclusion amount remains 15000.

For 2021 that lifetime exemption amount is 117 million. Estate Tax Exemption Basic Exclusion Amount 11700000. The unified tax credit rolls the gift and estate tax exclusions into one tax system and decreases the individuals or estates tax bill dollar.

How the gift tax exclusion works. 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption 11700000 11580000 Annual gift tax exclusion Gifts per person 15000 15000. Unified estate tax credit 2021 Saturday February 26 2022 Edit.

The recipient typically owes no taxes and doesnt have to report the gift unless it comes from a foreign source. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. Some items of interest from an estate planning perspective are the following.

For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35 million tax-free to your heirs. This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. How Might the Biden Administration Affect the Unified Tax Credit.

The 117 million exception in 2021 is set to expire in 2025. All people are qualified to take advantage of this tax perk from the Internal Revenue Service IRS. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021.

Dont leave your 500K legacy to the government. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including provisions concerning estate and gift taxesBeginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax.

The exclusion amount in 2021 increased to 11700000. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a. What Is the Unified Tax Credit Amount for 2021.

Qualified Small Business Property or Farm Property Deduction. The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to pay gift estate or transfer taxes. Is the one that spans estate and gift taxes.

The estate tax exemption is adjusted for inflation every year. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

The most common unified tax credit in the US. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. The unified credit against estate and gift tax in 2022 will be.

The tax is then reduced by the available unified credit. If you were married your spouse also a US. A tax credit is said to be unified when it applies to twoor sometimes moreseparate taxes.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

U S Estate Tax For Canadians Manulife Investment Management

U S Estate Tax For Canadians Manulife Investment Management

![]()

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Historical Features Of The Estate Tax Download Table

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Planning Strategies For Gift Splitting Fidelity

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Estate Planning 101 Presentation In 2021 Estate Planning How To Plan Estate Tax

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)